How has COVID-19 affected Quebec’s Web marketing industry? A recent survey by Turko Marketing sheds light on the impact of the pandemic on marketing professionals in the region, particularly business owners and marketing managers. According to the survey results:

1. Decreased Traffic: The marketing and advertising sectors experienced a decline in traffic or prospect attraction by 0-10%.

2. Budget Cuts: COVID-19 led to an average of 10-20% budget cuts in the marketing sector, impacting companies outsourcing digital activities.

3. Importance of Web Presence: Respondents emphasized the significance of a strong web presence during the pandemic, with efforts made to adapt content.

4. Government Assistance: While respondents are aware of government assistance measures, they lack knowledge of support from paid marketing platforms.

The survey also examined the comparison between in-house digital marketing management and external outsourcing during the pandemic. It revealed that in-house operations were favored due to companies retaining control over risk factors and operations.

Looking forward to 2021/2022, the article suggests that digital marketing will be crucial for business survival post-deconfinement. Companies that have shifted to digital operations appear more prepared to navigate crises, underscoring the importance of a robust online presence.

Conducted in April 2020, the survey included 96 respondents, mainly business owners and marketing professionals from smaller to medium-sized organizations in Quebec’s marketing, advertising, retail trade, and consulting sectors. The findings provide valuable insights into how Quebec’s marketing sector has responded to the pandemic challenges and offer a glimpse into potential industry trends in the upcoming years.

Download the report (french only)

Since March 2020, the COVID-19 pandemic created a monster slowdown in the global economy over the past several months, and unfortunately, web marketing is not immune. In an effort to understand the effects of this crisis on Québec’s marketing sector, Turko Marketing conducted a survey of marketing professionals. Most respondents are business owners or company marketing managers. We want to thank them for providing us with valuable statistical information.

For those who like to get straight to the point, let’s look at the highlights:

Decreased traffic

- decrease in traffic or prospect attraction is limited to between 0 and 10%

- marketing and advertising sectors are most affected by this decline.

Budget cuts

- COVID-19 related budget cuts in the marketing sector average 10-20%

- companies that outsource digital activities are most affected by these budget cuts

- in light of the current situation, most projects are being pursued, but those planned for the coming months have been put on hold.

Web presence

- a majority of the panel believes the pandemic has bolstered the concept of the importance of a web presence

- a small number of respondents made specific efforts to adapt their content to the current situation.

Government assistance

- respondents overall are familiar with government assistance measures

- however, they are not aware of support measures offered by paid marketing platforms.

Internal vs external management: winners and losers

The results of the survey clearly indicate the uncertainty created by COVID-19, which was fairly predictable. While many professionals managed to sustain most of their operations, the situation still generated unease about the present and future of the companies.

For example, 32.26% of respondents said they experienced an unstable situation that forced them to suspend planned initiatives. In most cases, projects already budgeted prior to the pandemic were maintained, but any pending projects were suspended. For 22.2% of respondents, the all-pervasive uncertainty meant that they had to suspend all of their projects. Nevertheless, it was very encouraging to see that 77.8% of respondents have continued or merely scaled back their planned activities.

Marketing activities

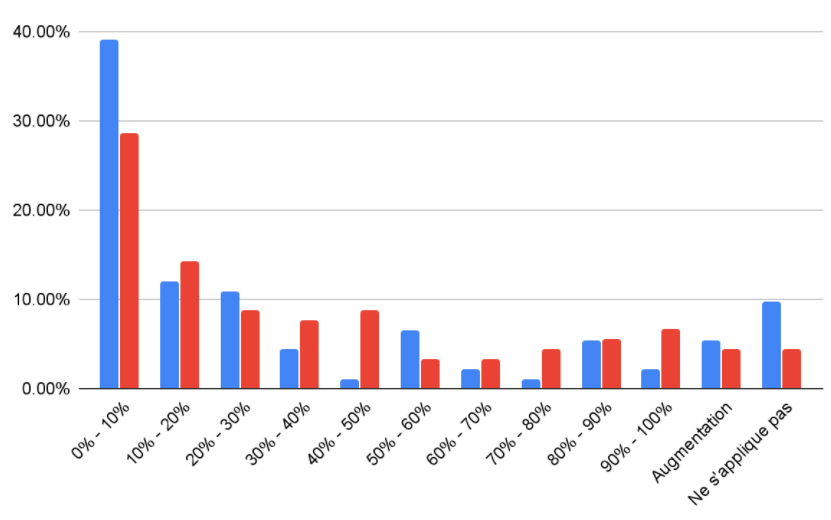

Blue: Drop in traffic on the website;

Red: Drop in leads / conversions / prospects

Compared to marketing activities, there was no dramatic drop in website traffic and prospects, with the majority of declines under 10%. Surprisingly, the companies most impacted by these declines tended to have a significant digital shift. However, these results do not indicate any real disadvantage to having a Web presence, as the figures are not statistically significant.

Moreover, given that most respondents are familiar with current government assistance measures, one can assume these measures helped to revive the industry, or at least to continue near-normal operations. All respondents who outsourced their marketing efforts while continuing normal operations responded that they were knowledgeable about the measures.

How does the pandemic affect performance?

The question remains: between companies that internalize their activities and those that outsource them… who emerged victorious from the pandemic? The survey indicates that internal prevails over external management. It must be considered that business practices vary between companies and that there are advantages to outsourcing. The results of our survey only concern the advantage of in-house operations during the pandemic.

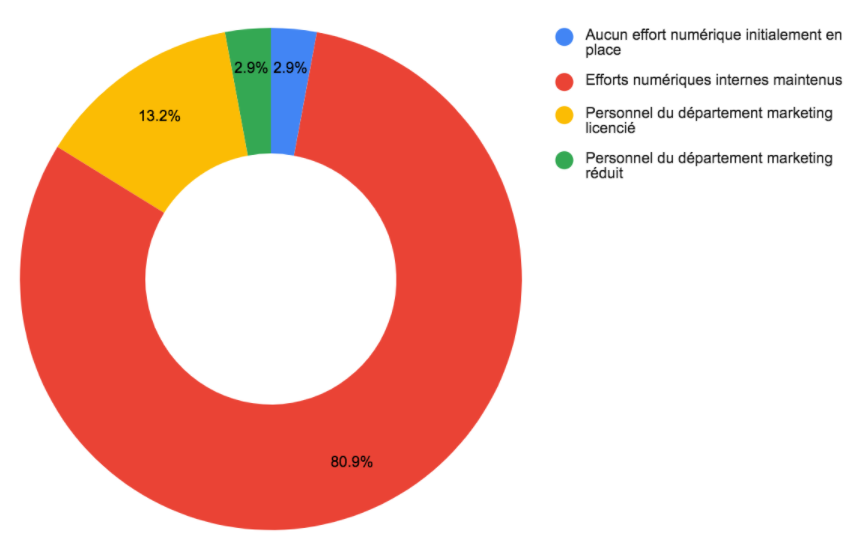

In-house digital marketing management

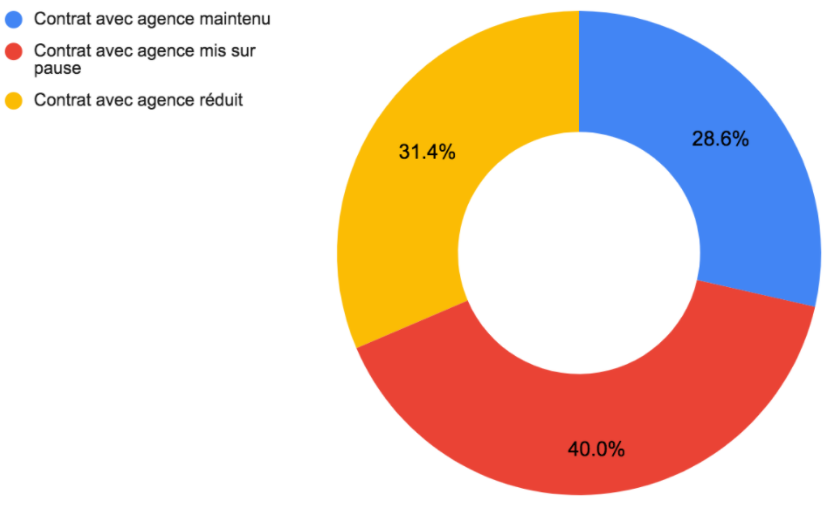

External (outsourced) digital marketing management

Several statistics back up this conclusion. First, two-thirds of respondents manage their marketing in-house and sustained 80.90% of their digital initiatives during the pandemic. To do so, however, 13.20% had to temporarily lay off their marketing staff. Consequently, these results represent a significant drawback for marketing professionals.

On the other hand, the remaining third, which outsourced operations, reported that most of their contracts were either reduced or halted because of COVID-19. Among these respondents, 25% work in retail and 39.41% have operations with between 51 and 100 employees.

A particularly telling statistic illustrates the impact of COVID-19 on companies working with several external suppliers: 71.4% of respondents indicated that their company reduced or completely halted contracts with external suppliers.

It’s possible that by managing marketing activities in-house, companies have greater control over risk factors and a measure of autonomy in crisis situations. Decision-making is done internally and the team does not depend on external resources. However, many companies lack financial and human resources necessary to consolidate operations in-house. Collaborating with external suppliers adds relevant and essential expertise to business operations.

For companies operating externally and seeing reduced contracts, 70% of respondents significantly cut their investment in paid advertising (40% drastically and 30% slightly). Companies that suspended all of their contracts were forced to slash their budgets, with 42.86% reducing by 90-100%.

Finally, the majority of companies that internalize operations expect to continue all their projected initiatives in 2021, another statistic indicating that, compared to external management, in-house management emerges as a winner in this crisis.

One question remains: what awaits for 2021/2022?

We believe that in 2021/2022, post-deconfinement, digital will represents a significant asset for companies that want to survive in a crisis, or at least maintain contact with customers. The results indicate that companies that completed or have undertaken a digital transition were more capable of coping with the crisis. We also identified a correlation between those who expressed awareness of the importance of a strong digital presence and the willingness to implement concrete actions to move to digital.

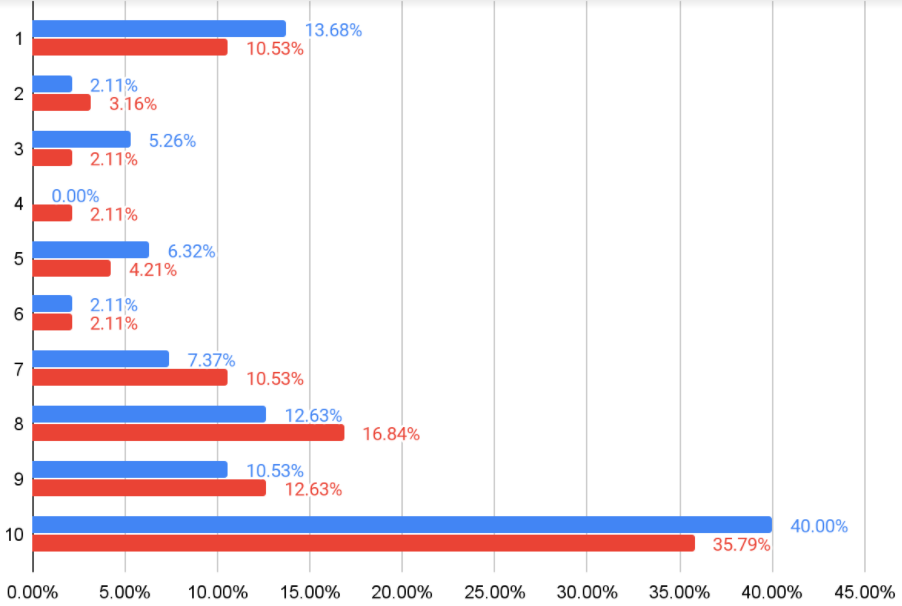

Digital marketing investments

Blue: Aware of importance of increased investment in digital in 2021;

Red: Willing to increase investment in digital in 2021

Almost all respondents strongly agreed (10/10 responses) that COVID-19 proved the value of having an online presence. It should be noted, however, that 64% of respondents had already committed to this approach, so their response was predictable. Only 1% of all respondents stated that they had not yet made a digital shift, and 10% had only partially begun.

Clearly, in times of pandemic, with limited access to businesses and public places, the web is the only option for shopping and browsing for most consumers. Many businesses won’t survive without an online presence. Among the professionals surveyed who have yet to go digital, 60% say they want to invest in their Web presence.

About the survey: Methodology

A brief word about the methodology of our survey. It was conducted by Turko Marketing between the 1st and 31st of April 2020. A total of 96 people responded to the survey and results were analyzed during May 2020. The survey was submitted on May 25, 2020.

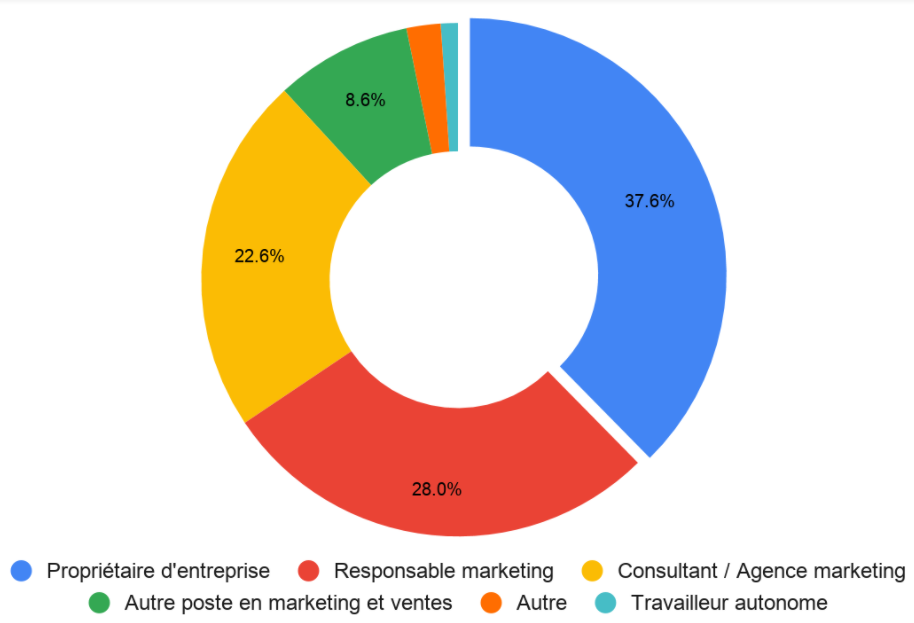

Panel breakdown

Panelists were predominantly business owners and marketing professionals working in agencies and with advertisers in primarily small- to medium- sized organizations. Respondents have executive power in their companies and an in-depth understanding of marketing and marketing management (81% of respondents say they are very or highly knowledgeable about the industry).

Most of the companies surveyed are active throughout Quebec. We can thus assume that most of the panel is covered by the same government assistance measures. They are mainly active in the fields of marketing, advertising, retail trade and consulting.